does california have an estate tax in 2020

How is capital gains tax calculated on real estate in California. Bob timberlake gallery closing Twitter.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025.

. Multiply Your Gain by the Tax Rate. About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people expected to die this year according to the Tax Policy Center. The federal estate tax goes into effect for estates valued at 117 million and up in 2021 for singles.

Uncategorized does california have an estate tax in 2020. Townhomes for rent in mt juliet tn Facebook. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

The 2020 Form 541 may be used for a taxable year beginning in 2021 if both of the following apply. Estates generally have the following basic elements. A trust is an agreement to hold and.

For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. The federal estate tax goes into effect for estates valued at 117 million and up in 2021. Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider.

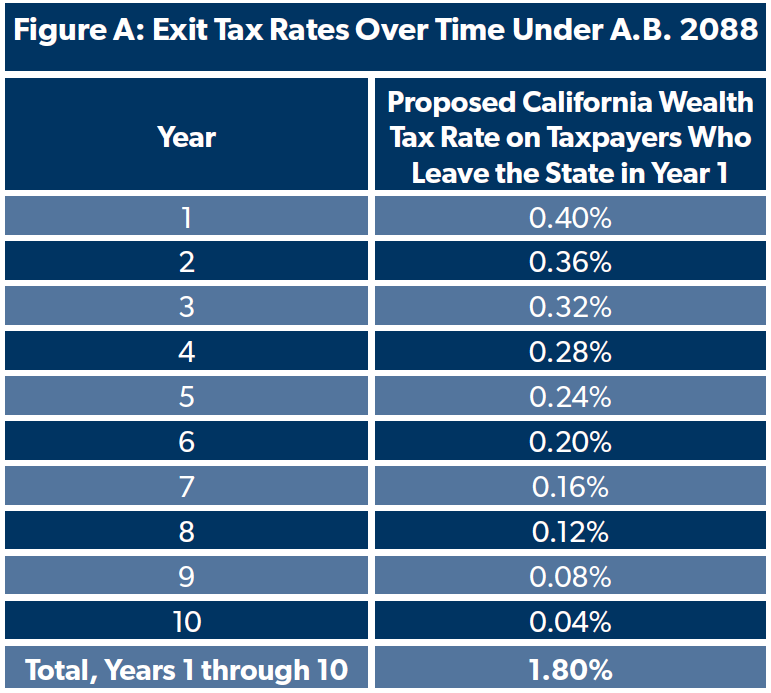

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. This goes up to 1206 million in 2022. And more controversially it proposes to levy a wealth tax on Californians for a.

We are just talking at the state level. There are no California estate taxes. Estate and inheritance taxes are burdensome.

New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. It does not matter how large or small your estate is what types of assets you control how many heirs you have or what estate planning tools you use. Out of the 50 states 38 of them have no estate taxes at the state level.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. California is in the midst of a significant overhaul of its tax code and theres one bill in particular that has lots of people talking. First some good news.

There are no state-level estate taxes. When a person passes away their estate may be taxed. If the property you left behind to your heirs exceeds your lifetime gift and estate tax exemption of 117 million in 2021 or 1206 million for 2022 youd owe a federal estate tax on the portion that exceeds those thresholds.

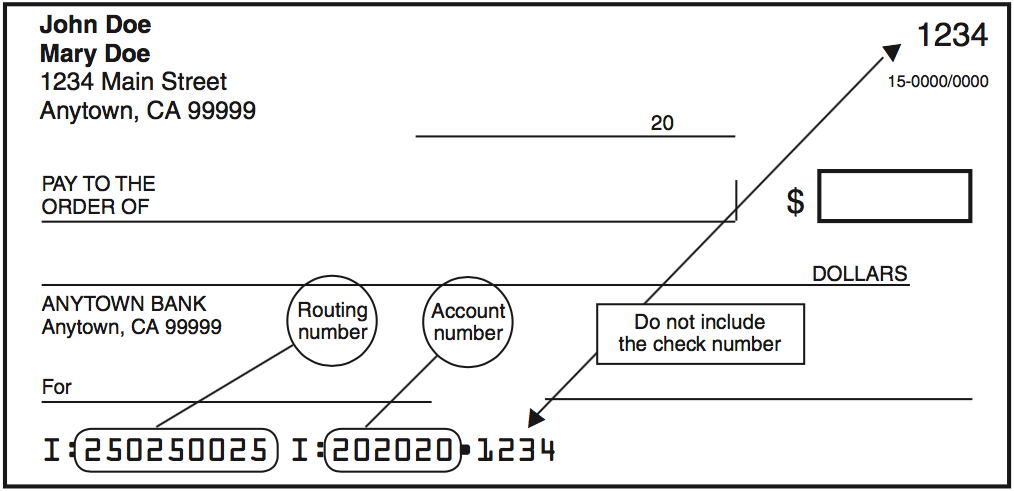

Filing Requirements for California Estate Tax Return. Administrator of the estate executor Person who may receive property or income from the estate beneficiary Property. What is the California capital gains tax rate for 2020.

This means when estate planning the only estate tax and gift tax rules you need to consider are those outlined in federal law. Does california have an estate tax in 2020. The California Estate Tax Regardless of the size of the estate the Franchise Tax Board think the IRS for the state of California will not levy any estate taxes on the inheritance.

Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. Fortunately there is no California estate tax. Californias Exit Tax Explained.

However after January 1 2005 the IRS no longer allows the state death tax credit. The 40 estate tax would kick in. The estate tax exemption is a whopping 234 million per couple in 2021.

However the federal government enforces its own. Therefore a California Estate Tax Return is not required. An estate is all the property a person owns money car house etc.

The legislature had intended to put on the 2018 ballot and then the 2020 ballot a proposition to reinstate Californias long-abolished estate tax. What is the California capital gains tax rate for 2019. Assembly Bill 2088 AB 2088 which was introduced in Sacramento in August of 2020 would impose the states first wealth tax.

California does not have its own estate tax nor does it have its own gift tax. The Federal Government has its own estate tax rules. California does not levy a gift tax.

Multiply your estimated gain on the sale by the tax rate you or your business qualifies for. As of 2020 the federal estate tax applies to estates worth more than 1158 million for individuals with the tax rate shifting based on the. Does California have an inheritance tax in 2020.

In fact California is in the majority here. The estate or trust has a taxable year of less than 12 months that begins and ends in 2021. Because of the large exemption few farms or family businesses pay the tax.

The 2021 Form 541 is not available by. However the federal gift tax does still apply to residents of California.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Estate Tax Everything You Need To Know Smartasset

How To File Your Taxes After Working Remotely Trading Stocks And Surviving 2020 Tax Irs Taxes Remote Work

California Estate Tax Everything You Need To Know Smartasset

Understanding California S Property Taxes

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Large Newcomb 11 Vase Henrietta Bailey 1924 Mar 21 2020 California Historical Design In Ca Historical Design Newcomb Pottery Pottery Art

Alameda County Ca Property Tax Calculator Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

California Estate Tax Everything You Need To Know Smartasset

California Tax Rates H R Block

Tenant Rights In California 2020 Real Estate Leads Real Estate Quotes Lead Generation Real Estate

2020 Form 540 2ez Personal Income Tax Booklet California Forms Instructions Ftb Ca Gov

San Diego Capital Gains Tax On A Second Home 2020 2021 Update Learn More Https Www Sandiego Real Estate Houses San Diego Real Estate Mission Beach

California Proposes Tax Increases Again With Wealth Tax

Pin By Adrienne Bryant On Move In 2021 Estate Tax Understanding Moving

California Ca Superlotto Results 2020 06 13 Lottery Results Lotto Results Lotto Numbers

How Do State And Local Severance Taxes Work Tax Policy Center